B2B Sales Success in Ontario: Local Lead Generation Strategies That Convert

Published: 1/29/2026

Ontario's B2B market generated approximately $186.9 billion in 2023, making it Canada's largest business-to-business opportunity. You're looking at a market projected to reach $757.5 billion by 2030 with a 22.1% compound annual growth rate. This represents one of North America's most profitable B2B territories.

Your biggest challenge? Longer decision cycles, complex buying processes, and multiple stakeholders who need alignment before any purchase decision happens. Ontario businesses take 3-6 months on average to close mid-market deals, which means your sales strategy needs precision timing and relationship-building expertise.

Here's what you'll discover in this complete guide: proven local lead generation strategies specifically designed for Ontario's market dynamics, regulatory compliance requirements that protect your business, high-opportunity industries driving the most growth, and cultural intelligence that builds trust with Canadian prospects.

Companies like Local Leads are changing how businesses identify and connect with newly registered Ontario businesses, providing the timing advantage that makes all the difference in competitive markets. Their AI-powered platform delivers fresh opportunities directly to your inbox before competitors even know these prospects exist.

Key Takeaways

Ontario's B2B market is projected to reach $757.5 billion by 2030 with 22.1% CAGR, creating massive opportunities across all sectors. Newly registered businesses offer the highest conversion potential due to immediate service needs and lack of existing vendor relationships. Cultural understanding and relationship-building remain important for Ontario B2B success, while geographic and industry targeting improves lead quality and sales outcomes. Compliance with PIPEDA and CASL regulations is mandatory for sustainable B2B operations in Canada's largest provincial market.

Understanding Ontario's B2B Sales Landscape

Ontario drives approximately 40% of Canada's national GDP, establishing itself as the country's undisputed economic powerhouse. The current B2B market value of $186.9 billion positions Ontario ahead of many entire countries in terms of business-to-business opportunity size.

Your market characteristics differ from B2C environments. You're dealing with fewer but larger customers, where individual deals can range from $50,000 to several million dollars depending on your industry. Decision cycles typically span 3-6 months for mid-market transactions, requiring sustained relationship development and multiple stakeholder engagement.

The digital transformation acceleration post-2020 changed how Ontario businesses operate and purchase services. B2B e-commerce adoption increased by 300% between 2020-2023, creating new opportunities for companies offering digital solutions, cloud migration services, and technology consulting.

Multiple stakeholders complicate your sales process but also create opportunity. Finance teams focus on ROI and budget allocation. Operations teams evaluate implementation complexity and workflow integration. Executive leadership considers strategic alignment and competitive advantage. Your sales approach must address each stakeholder's specific concerns and decision criteria.

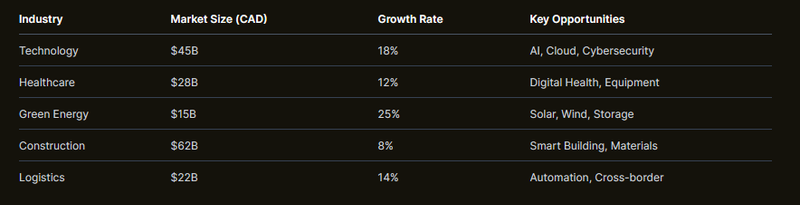

Growth projections through 2030 indicate sustained expansion across all major sectors. Technology services lead with 18% annual growth, followed by green energy solutions at 25%, and healthcare technology at 12%. These sectors represent your highest-opportunity targets for B2B sales development.

High-Opportunity Industries for B2B Sales in Ontario

Technology and digital solutions represent Ontario's fastest-growing B2B sector, valued at $45 billion with 18% annual expansion. SaaS platforms, cloud migration services, and cybersecurity solutions drive this growth as businesses modernize their operations. You'll find particular opportunity in AI implementation, data analytics platforms, and cybersecurity consulting as Canadian businesses prioritize digital security.

Healthcare and life sciences generate $28 billion in B2B transactions annually, growing at 12% per year. Healthcare IT systems, electronic health records, medical equipment distribution, and pharmaceutical supply chain solutions create substantial opportunities. Regulatory compliance services supporting Health Canada requirements represent a specialized but lucrative niche.

Green energy and environmental services produce $15 billion in annual B2B revenue with impressive 25% growth rates. Renewable energy equipment installation, environmental consulting, sustainable infrastructure engineering, and carbon footprint reduction services benefit from government incentives and corporate sustainability mandates.

Construction and infrastructure maintain Ontario's largest B2B sector at $62 billion annually, though growing at a modest 8% rate. Building material suppliers, heavy equipment leasing, engineering services, and smart building technology represent stable, high-volume opportunities. The sector's size compensates for slower growth through consistent deal flow.

Logistics and supply chain optimization generates $22 billion in annual business, expanding 14% yearly as e-commerce drives demand. Warehouse automation systems, fleet management solutions, cross-border trade facilitation, and last-mile delivery optimization create opportunities for technology-forward service providers.

Focus your prospecting efforts on these high-growth sectors for maximum return on sales investment. Technology and green energy offer the highest growth rates, while construction and healthcare provide volume opportunities with predictable demand patterns.

The Power of Targeting Newly Registered Businesses

New businesses represent your highest-conversion prospects because they face immediate service needs without existing vendor relationships to complicate your sales process. You're competing against zero instead of fighting entrenched competitors who've built relationships over years.

Timing creates your competitive advantage. Newly registered businesses need essential services immediately: accounting and bookkeeping, legal consultation, marketing and branding, IT infrastructure, and business insurance. They're actively seeking providers rather than passively considering future changes.

Your response rates improve dramatically with timing precision. New businesses are 3x more likely to respond to sales outreach in their first 30 days of operation compared to established companies. 67% of newly registered businesses actively seek service providers within 60 days of incorporation, creating a predictable opportunity window.

First-contact advantage can improve your close rates by up to 40% compared to competing against established vendor relationships. When you reach prospects before competitors discover them, you're positioned as the solution rather than an alternative to consider.

Data-driven identification systems transform how you discover these opportunities. Business registration monitoring provides real-time alerts when companies matching your ideal client profile incorporate in Ontario. Geographic targeting ensures you focus on prospects within your service area, while industry filtering eliminates irrelevant opportunities.

Contact information extraction and verification eliminates the research time typically required for prospecting. You receive verified email addresses, phone numbers, and key executive contact details immediately upon business registration, enabling same-day outreach when prospects are most receptive.

The urgency factor works in your favor. New businesses operate under time pressure to establish operations, secure customers, and generate revenue. This urgency creates faster decision-making processes compared to established companies with existing systems and longer evaluation cycles.

How Local Leads Transforms Ontario B2B Sales

Our AI-powered platform changes how you discover and connect with newly registered Ontario businesses. We monitor business registrations in real-time across all Ontario jurisdictions, delivering fresh opportunities directly to your inbox before competitors know these prospects exist.

Advanced filtering capabilities ensure you receive only relevant opportunities. Set parameters for industry type, geographic location, company size indicators, and registration date ranges. Our algorithms match incoming business registrations against your criteria, sending notifications only for prospects fitting your ideal client profile.

Geographic precision covers Ontario comprehensively from Toronto's financial district to Ottawa's government sector, Hamilton's manufacturing base to London's diverse economy. Whether you serve local markets or operate province-wide, our targeting ensures you discover opportunities in your service territories.

Industry-specific targeting spans all major B2B sectors including technology services, healthcare solutions, construction suppliers, professional services, and manufacturing support. We track registration details indicating business focus, enabling precise prospect matching for your specific solutions and services.

Company sizing data helps qualify opportunities before outreach. We extract employee projections, initial investment indicators, and business scope information from registration documents, allowing you to prioritize prospects matching your deal size requirements.

Online activity monitoring gauges business readiness for your solutions. We track website launches, social media establishment, and digital presence development, indicating when new businesses are actively building their operations and most receptive to service providers.

Competitive intelligence features give you first-contact advantage. Our watchlist management system monitors your defined criteria continuously, alerting you to opportunities within hours of business registration. Advanced search algorithms identify relevant matches others might miss, while complete contact profiles include verified emails, phone numbers, and social media connections.

Users report more qualified leads per day through our platform. Higher response rates result from perfectly timed outreach when prospects need your services most. Improvement in close ratios follows from eliminating competition with existing service providers.

Our web-based platform requires no software installation or complex setup. Define your target criteria in minutes, activate watchlists for ongoing monitoring, and receive qualified leads via email notifications. Flexible pricing starts at $49 monthly for small businesses, scaling to enterprise solutions for larger sales teams.

Essential Legal and Regulatory Compliance for Ontario B2B Sales

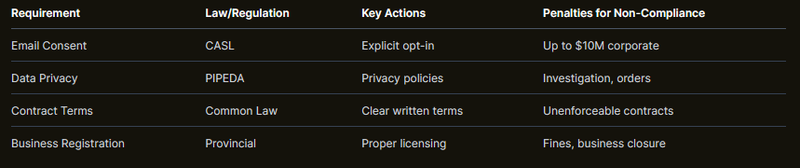

Contract law in Ontario follows common law principles requiring offer, acceptance, consideration, and mutual intention to create binding agreements. Your contracts must include clear terms for enforceability, with written agreements strongly recommended for transactions over $5,000.

Dispute resolution mechanisms should be specified in your contracts, including jurisdiction selection for legal proceedings and alternative resolution options like mediation or arbitration. Ontario courts generally enforce properly structured commercial agreements between businesses.

Privacy and data protection compliance under PIPEDA affects all commercial data collection and use. The Personal Information Protection and Electronic Documents Act requires explicit consent for collecting personal information, clear privacy policies explaining data handling procedures, and individual rights for information access and correction.

Record your consent mechanisms and maintain documentation proving compliance. Privacy policies must explain what information you collect, how you use it, who you share it with, and how individuals can access or correct their personal data. Breaches must be reported to the Privacy Commissioner within specific timeframes.

Canada's Anti-Spam Legislation (CASL) governs all commercial electronic messages including emails, texts, and social media communications. Express consent is required before sending commercial messages, with implied consent limited to specific business relationship circumstances.

Identification requirements mandate that all commercial electronic messages include sender identification, contact information, and unsubscribe mechanisms. Unsubscribe requests must be processed within 10 business days, with clear instructions provided to recipients.

Record-keeping requirements under CASL demand documentation proving consent for every recipient on your marketing lists. Maintain records showing when consent was obtained, how it was obtained, and the specific consent language used. Corporate penalties reach up to $10 million for violations.

Ontario Consumer Protection considerations influence B2B practices through fair dealing requirements and contract fairness standards. While primarily targeting consumer transactions, these principles increasingly affect business-to-business relationships, particularly with smaller companies.

Compliance protects your business and builds trust with prospects. Canadian businesses expect proper regulatory adherence and often verify compliance before engaging service providers.

Proven B2B Sales Strategies for the Ontario Market

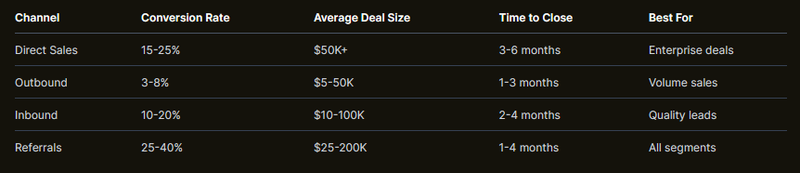

Direct sales and relationship building remain the foundation of Ontario B2B success. Personalized outreach strategies acknowledging prospect-specific challenges and opportunities outperform generic messaging. Focus on long-term relationship development rather than quick transactions, as Ontario businesses value sustainable partnerships.

Account-based marketing approaches work well in Ontario's concentrated business districts. Target specific companies with customized messaging addressing their industry challenges, competitive pressures, and growth opportunities. Regular follow-up and nurturing processes maintain engagement throughout extended decision cycles.

Outbound lead generation requires understanding Canadian communication preferences. Cold emails should be direct but respectful, acknowledging the prospect's time constraints while clearly articulating your value proposition. LinkedIn outreach strategies targeting Ontario professionals benefit from local connection and shared business community references.

Phone prospecting timing matters in Ontario markets. Avoid early morning calls before 9 AM and late afternoon contacts after 4 PM. Tuesdays through Thursdays generate highest response rates, while Mondays and Fridays see reduced availability due to weekend transitions and meeting scheduling.

Multi-touch campaign development spans 6-8 touchpoints over 3-4 weeks for optimal results. Combine email outreach, LinkedIn engagement, phone calls, and valuable content sharing to maintain prospect awareness without appearing aggressive or intrusive.

Inbound marketing optimization focuses on SEO strategies targeting Ontario-specific keywords and search patterns. Content marketing addressing local business challenges like CASL compliance, cross-border commerce, and seasonal business fluctuations attracts qualified prospects researching solutions.

Pay-per-click advertising with geographic targeting maximizes budget efficiency by focusing on Ontario searchers. Landing page optimization for Canadian audiences includes local testimonials, case studies, and currency displays building immediate credibility and relevance.

Referral network development creates sustainable lead generation beyond direct prospecting. Build strategic partnerships with complementary service providers serving similar client bases. Customer referral programs with structured incentives encourage satisfied clients to recommend your services.

Professional association involvement and industry event participation establish your credibility within Ontario business communities. Chamber of Commerce membership, trade association participation, and conference speaking opportunities position you as an industry expert.

Sales process optimization through lead qualification frameworks like BANT (Budget, Authority, Need, Timeline) or MEDDIC (Metrics, Economic Buyer, Decision Criteria, Decision Process, Identify Pain, Champion) improves conversion rates and reduces sales cycle length.

Focus your resources on referral development and direct sales for highest conversion rates, while maintaining outbound and inbound activities for consistent pipeline flow.

Cultural Intelligence and Business Etiquette in Ontario

Communication preferences in Ontario favor direct, polite, and respectful interaction styles. Honesty and transparency build trust more effectively than aggressive sales tactics or exaggerated claims. Professional tone combined with personal relationship building creates the ideal balance for B2B success.

Email and phone communications should be concise and value-focused, respecting busy schedules while clearly articulating your purpose. Avoid high-pressure tactics or artificial urgency, as Ontario businesses prefer consultative approaches allowing proper evaluation time.

Meeting culture emphasizes punctuality as a sign of respect and professionalism. Arrive 5-10 minutes early for appointments, dress in formal business attire, and maintain conservative appearance standards. Late arrivals damage credibility and suggest poor organizational skills.

Structured agenda-driven meetings align with Ontario business preferences for efficient time usage. Prepare clear objectives, supporting materials, and specific outcomes you're seeking. Decision-making processes often involve consensus building among stakeholders, requiring patience and multiple touchpoints.

Trust and relationship building require long-term focus over transactional approaches. Reliability and consistency in your communications, commitments, and service delivery establish the foundation for successful partnerships. Ontario businesses evaluate vendors based on track record and referential credibility.

Social proof and references provide important credibility indicators. Maintain case studies showcasing successful Ontario client relationships, gather testimonials highlighting specific results achieved, and develop referral networks within your target industries.

Gradual relationship development through regular touchpoints, valuable content sharing, and industry insight provision nurtures prospects through extended consideration periods. Rushing decisions or applying pressure typically backfires in Ontario's relationship-focused business culture.

Seasonal considerations affect business activity patterns around Canadian holidays including Canada Day, Thanksgiving in October, and extended Christmas/New Year breaks. Winter weather impacts travel and in-person meetings, particularly in northern Ontario regions.

Regional differences exist between Toronto's fast-paced financial district, Ottawa's government-focused environment, and smaller cities' community-oriented business cultures. Adapt your approach based on local business dynamics and relationship expectations.

Bilingual considerations apply in certain Ontario regions with French-speaking populations. While English dominates business communications, offering French-language materials or bilingual representatives can provide competitive advantages in specific markets.

Measuring and Optimizing Your Ontario B2B Sales Performance

Key performance indicators must reflect Ontario's unique market characteristics and longer decision cycles. Lead generation metrics include volume, quality scores, and source attribution to identify your most productive channels. Track geographic distribution to ensure coverage across your target territories.

Sales pipeline metrics focus on conversion rates between stages, velocity measurements showing time from first contact to close, and average deal sizes by industry and region. These indicators help optimize resource allocation and identify bottlenecks requiring attention.

Customer acquisition cost (CAC) calculations must account for Ontario's extended sales cycles and relationship-building requirements. Lifetime value (LTV) projections benefit from Ontario businesses' tendency toward long-term partnerships once relationships are established.

Geographic and industry-specific performance tracking reveals patterns enabling strategic adjustments. Technology sector prospects may respond faster to digital outreach, while construction companies prefer phone conversations and in-person meetings.

Technology stack optimization begins with CRM system selection supporting complex B2B sales processes. Canadian-compliant systems handling PIPEDA and CASL requirements eliminate compliance risks while providing necessary functionality.

Sales automation tools integration streamlines repetitive tasks without losing personal touch essential for Ontario relationship building. Lead scoring and qualification systems prioritize prospects based on engagement levels, company characteristics, and behavioral indicators.

Reporting and analytics dashboards provide real-time visibility into sales performance, pipeline health, and opportunity trends. Custom metrics tracking Ontario-specific factors like seasonal variations and regional differences guide tactical adjustments.

Continuous improvement processes include regular sales performance reviews identifying successful tactics for replication across your team. A/B testing for outreach messages, meeting requests, and proposal formats optimizes conversion rates systematically.

Customer feedback collection provides insights into your value proposition effectiveness and service delivery quality. Analysis of won and lost deals reveals competitive strengths and weaknesses requiring strategic attention.

Market trend monitoring through industry publications, business journals, and economic reports helps anticipate opportunities and challenges. Strategy adjustment based on changing market conditions maintains your competitive positioning.

Scaling successful strategies requires identifying high-performing tactics suitable for broader application. Team training and knowledge sharing processes ensure consistent execution across your sales organization.

Territory expansion and market penetration strategies apply successful approaches in new geographic regions or industry verticals. Technology upgrades and capability enhancement support growth while maintaining service quality.

Future Trends and Opportunities in Ontario B2B Sales

Artificial intelligence transforms sales process automation through predictive analytics, lead scoring optimization, and personalized communication at scale. AI-powered prospect research identifies decision-makers, pain points, and optimal outreach timing automatically.

Advanced data analytics enable sophisticated prospect identification beyond traditional demographic and firmographic criteria. Behavioral indicators, digital footprints, and engagement patterns predict buying readiness with increasing accuracy.

Virtual and augmented reality applications enhance product demonstrations and remote client engagement. Complex solutions requiring physical inspection can now be showcased effectively without travel requirements, expanding your geographic reach.

Blockchain applications in B2B transactions provide enhanced security, transparency, and efficiency for large deals requiring multiple approvals and documentation. Smart contracts automate payment processing and compliance verification.

Changing buyer behaviors reflect increased digital research before vendor contact. Modern prospects complete 60-70% of their buying journey independently, requiring earlier engagement through valuable content and thought leadership.

Committee-based decision making becomes more common as business purchases involve multiple stakeholders from different departments. Your sales process must address diverse concerns and build consensus among various decision influencers.

Demand for personalized, relevant sales experiences increases as buyers expect vendor communications tailored to their specific industry, role, and business challenges. Generic messaging loses effectiveness as sophistication standards rise.

Preference for consultative selling approaches over traditional product-focused presentations grows as buyers seek strategic advisors rather than simple vendors. Position yourself as an expert guide addressing complex business challenges.

Market evolution predictions indicate continued growth in SaaS and subscription-based business models across all industries. Recurring revenue opportunities replace one-time transactions in many sectors.

Increased focus on sustainability and ESG (Environmental, Social, Governance) considerations influences vendor selection criteria. Businesses evaluate suppliers based on environmental impact, social responsibility, and governance practices.

Cross-border digital commerce expansion creates opportunities for service providers supporting international trade, customs compliance, and currency management. Ontario's position as a trade hub amplifies these opportunities.

Integration of social selling and digital channels requires developing expertise in LinkedIn engagement, content marketing, and online relationship building alongside traditional sales skills.

Preparation strategies for future success include skills development for digital-first selling environments. Technology investment planning ensures your tools and platforms support evolving buyer expectations and market requirements.

Partnership and ecosystem development creates collaborative advantages as business solutions become increasingly complex and integrated. Strategic alliances provide comprehensive solutions beyond individual company capabilities.

Regulatory compliance preparation addresses evolving privacy laws, data protection requirements, and cross-border commerce regulations affecting B2B operations. Proactive compliance management prevents costly violations and business disruptions.

Taking Action in Ontario's B2B Market

Ontario's $186.9 billion B2B market growing to $757.5 billion by 2030 represents unprecedented opportunity for prepared businesses. Your success depends on understanding market dynamics, regulatory requirements, and cultural preferences that differentiate Ontario from other markets.

Timing advantage through new business targeting provides your most direct path to competitive advantage. Newly registered businesses need your services immediately, respond more readily to outreach, and lack existing vendor relationships creating barriers to entry.

Implementation starts with defining your target market precisely by industry, geography, and company characteristics. Activate monitoring systems tracking new business registrations in your service areas. Develop outreach sequences optimized for Canadian communication preferences and regulatory requirements.

Regulatory compliance protects your business while building trust with prospects who expect professional adherence to PIPEDA, CASL, and contract law requirements. Invest in proper systems and training preventing costly violations while demonstrating credibility.

Cultural understanding and relationship-building distinguish successful Ontario B2B operations from those treating it as simply another territory. Long-term thinking, honest communication, and consistent reliability create the partnerships driving sustainable growth.

Success measurement requires tracking metrics reflecting Ontario's extended decision cycles and relationship-focused culture. Monitor lead quality over quantity, relationship development progress, and long-term customer value rather than short-term transaction volume.

Your competitive advantage emerges from combining market intelligence, timing precision, cultural competency, and regulatory compliance into a comprehensive Ontario B2B strategy. Companies implementing these elements systematically capture disproportionate market share in Canada's largest B2B opportunity.

Start by auditing your current approach against Ontario market requirements. Identify gaps in compliance, cultural understanding, or timing advantage. Develop implementation timelines addressing highest-impact improvements first, building comprehensive capabilities supporting long-term market dominance.

Frequently Asked Questions

What makes Ontario's B2B market different from other Canadian provinces?

Ontario represents 40% of Canada's GDP with the most diverse economy, longest decision cycles, and highest deal values. The market combines Toronto's financial district, Ottawa's government sector, and extensive manufacturing base creating unique complexity requiring specialized approaches.

How quickly should I contact newly registered businesses in Ontario?

Contact new businesses within 24-48 hours of registration for maximum response rates. They're 3x more likely to respond in their first 30 days, with 67% actively seeking service providers within 60 days of incorporation.

What are the most important compliance requirements for Ontario B2B sales?

CASL requires explicit consent for commercial emails with proper identification and unsubscribe mechanisms. PIPEDA governs personal information collection and use requiring privacy policies and consent documentation. Contract law mandates clear written terms for enforceability.

Which industries offer the highest growth potential in Ontario's B2B market?

Green energy leads with 25% annual growth, followed by technology at 18% and logistics at 14%. Healthcare maintains steady 12% growth while construction provides volume opportunities at 8% annually.

How long do B2B sales cycles typically take in Ontario?

Mid-market B2B deals average 3-6 months from first contact to close, with enterprise deals potentially extending 6-12 months due to committee decision-making and thorough evaluation processes requiring relationship development and trust building.