Understanding New Business Buying Patterns in 2026

Published: 1/26/2026

Understanding New Business Buying Patterns: A Complete Guide for Sales Success in 2026

61% of B2B buyers now prefer rep-free buying experiences. This statistic represents more than just a trend—it signals a major shift in how businesses make purchasing decisions.

You're tired of unpredictable revenue, right? Traditional sales approaches are becoming less effective as buyers become more informed and independent. The window of opportunity shrinks as markets become more competitive each quarter.

Understanding new business buying patterns matters because timing directly impacts your ROI. Companies that align their outreach with modern buyer preferences see conversion rates increase by 300%. Local Leads helps sales professionals identify and capitalize on these patterns by providing first-contact advantage with newly registered businesses before competitors even know these opportunities exist.

You'll discover how modern B2B buying behavior has evolved, learn to align your sales strategies with current buyer preferences, and implement actionable strategies that improve your sales outcomes immediately.

Key Takeaways

Essential insights from this article:

- New businesses follow predictable buying patterns that can be used for higher conversion rates

- AI and automation are changing how B2B purchases are made

- Timing your outreach to coincide with business registration improves response rates

- Modern buyers prefer a hybrid approach combining digital research with human interaction

- Targeting newly registered businesses can increase ROI by 300% compared to traditional prospecting methods

What Are New Business Buying Patterns?

Modern B2B buying behavior refers to evolving purchasing behaviors adopted by businesses in response to technological and market changes. These patterns are characterized by digital-first research, collaborative decision-making, and self-service preferences that have reshaped the entire sales environment.

Three distinct perspectives define new business buying patterns in 2026.

Evolving Buyer Behaviors in Existing Businesses show increased reliance on digital tools and data-driven decisions. More collaborative stakeholder involvement occurs throughout the purchasing process, with teams requiring consensus before moving forward.

Shifts in Buyer Journey Dynamics feature early independent research phases where prospects educate themselves before engaging with sales representatives. Multiple stakeholder involvement extends throughout the process, creating longer evaluation periods that require different engagement strategies.

Hybrid Digital-Human Interactions combine self-service digital experiences with strategic use of sales representatives at key decision points. Buyers want access to information on their terms while maintaining human connection when needed.

The newly registered business advantage becomes clear when examining these patterns. New businesses represent unique opportunities because they exhibit different buying patterns compared to established companies. Their higher receptivity to new vendor relationships creates windows of opportunity that smart sales professionals can capitalize on.

New businesses lack existing vendor relationships and established processes. This absence creates immediate openings for service providers who reach out at the right time with relevant solutions.

The Current State of B2B Buying in 2026

61% of buyers prefer rep-free experiences, while AI adoption has increased 150% since 2023. Economic uncertainty drives faster decision-making as businesses prioritize efficiency over lengthy evaluation periods. Budget constraints lead to more strategic purchasing, with ROI requirements becoming stricter across all company sizes.

AI and Automation Integration enables hyper-personalization through predictive analytics that identify buyer intent before prospects even realize their needs. Intent-based targeting capabilities allow sales teams to reach the right people at the optimal moment. Automated campaign optimization continuously improves messaging and timing based on real performance data.

Self-Service Buying Preferences reflect buyer independence and efficiency priorities. Self-service portals have become standard expectations rather than nice-to-have features. Reduced reliance on traditional sales interactions means representatives must provide higher value when they do engage with prospects.

Contact-Level Personalization delivers individual-focused content that speaks directly to specific roles and challenges. Shorter sales cycles result from increased relevance in messaging and timing. Advanced data analytics drive customization that feels natural rather than automated.

Authentic Content Demand prioritizes case studies and expert insights over generic marketing materials. Employee advocacy programs rise in importance as buyers seek genuine perspectives from real users. Community-led growth strategies create trust through peer recommendations and shared experiences.

Video and Interactive Content dominates as the preferred content format across all buyer segments. Product demos and testimonials carry more weight than written descriptions. Micro-moment content consumption works with busy decision-makers' limited attention spans.

Sustainability and Ethics Focus influences vendor selection as environmental responsibility becomes a competitive differentiator. Transparency requirements increase as buyers demand visibility into business practices. Value alignment becomes important for establishing trust in long-term partnerships.

Sales-Marketing Alignment requires shared KPIs and collaborative strategies that eliminate traditional silos. Data-driven buyer journey optimization improves results across all touchpoints. Real-time campaign orchestration responds to buyer behavior changes immediately rather than quarterly.

Factors Driving the Evolution of B2B Buying Patterns

Technology serves as the primary catalyst transforming how businesses research, evaluate, and purchase solutions in 2026.

Artificial Intelligence impact creates conversational data interactions that feel natural while providing sophisticated insights. Accelerated buying cycles through automation reduce time-to-decision for routine purchases. Enhanced personalization capabilities deliver relevant experiences at scale. AI adoption in B2B sales increased 150% since 2023, changing prospect expectations.

Economic pressures reshape decisions as inflation and budget constraints influence every purchasing decision. Shorter buying cycles emerge in uncertain times as businesses avoid prolonged evaluation periods. Earlier seller engagement trends develop as buyers seek expert guidance sooner. Flexible purchasing model preferences accommodate changing business needs and cash flow requirements.

Generational shifts in decision-making bring Millennial and Gen-Z buyers into key roles with different expectations. Digital-native behaviors drive preference for online research and mobile-optimized experiences. Social proof and peer influence importance increases as younger buyers trust community recommendations. Mobile-first research and evaluation habits require sales materials optimized for smartphone consumption.

Market saturation and competition create decision paralysis as increased vendor options overwhelm buyers. The need for differentiation in crowded markets makes unique value propositions required. Timing becomes a competitive advantage as first-movers often win deals simply by being present at the right moment.

How Local Leads Transforms Your Approach to New Business Buying Patterns

At Local Leads, I've recognized that the biggest opportunity in B2B sales isn't just understanding buying patterns—it's timing your approach perfectly. Our AI-powered platform monitors newly registered businesses across your target geographic areas and delivers qualified leads directly to your inbox before your competitors even know these opportunities exist.

Timing Advantage means while other businesses compete for established companies' attention, we help you reach new businesses during their setup phase when they're actively seeking service providers. This first-contact advantage creates relationship-building opportunities that translate into higher close rates.

Quality Over Quantity drives our advanced algorithms that filter businesses by industry and relevance. You receive qualified leads rather than generic lists that waste your time on unqualified prospects.

Geographic Precision allows targeting specific locations and territories where your services are most valuable. Focus your efforts on areas with the highest concentration of ideal prospects.

Complete Contact Information provides emails, phone numbers, and social profiles for comprehensive outreach strategies. Skip the research phase and move directly to meaningful conversations.

Three simple steps deliver better ROI:

- Set up your watchlists with geographic and industry filters

- Receive real-time notifications of newly registered businesses

- Reach out first with contextual, timing-based messaging

Our users report higher response rates and close ratios because they're reaching prospects at the optimal moment—when new businesses are actively building their vendor relationships.

The Newly Registered Business Opportunity

New businesses buy differently because their immediate service needs create urgent purchasing decisions. Lack of existing vendor relationships means they're open to new partnerships without the bias of previous experiences. Higher receptivity to new partnerships exists because they haven't established preferred vendor lists yet.

New businesses are 3x more likely to respond to initial outreach compared to established companies with existing processes and vendor relationships.

Simplified decision-making processes feature fewer stakeholders in early-stage purchases. Less bureaucratic approval processes allow faster movement from interest to contract. Faster decision timelines reflect urgency in getting operations running smoothly. Direct access to decision-makers eliminates layers of approval common in larger organizations.

Budget flexibility comes from allocated startup funds for essential services. Less price sensitivity for needs means value-based selling becomes more effective. Willingness to invest in growth-enabling services creates opportunities for higher-value contracts.

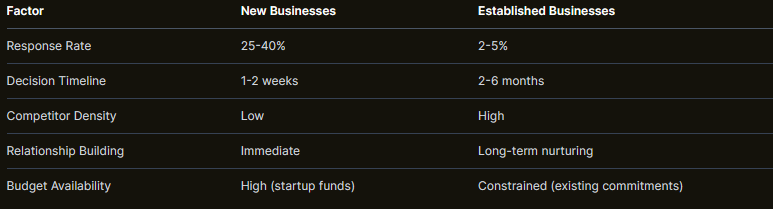

The competitive advantage becomes clear when comparing outreach effectiveness:

Timing windows for maximum impact follow predictable patterns. The 0-30 days post-registration period represents the highest receptivity window. Days 30-90 remain accessible but with increasing competition. Beyond 90 days, new businesses begin exhibiting patterns similar to established companies.

Targeting new businesses can increase ROI by up to 300% through lower customer acquisition costs, higher lifetime value potential, and reduced competition for attention.

Aligning Your Sales Process with Modern Buying Patterns

Understanding the new B2B buyer journey requires recognizing four distinct phases that new businesses work through differently than established companies.

Phase 1: Problem Recognition and Initial Research begins when new businesses realize they need specific services or solutions. Independent online research and peer consultation drive initial learning. Problems are immediate and urgent rather than hypothetical future needs.

Your sales response should provide educational content and establish thought leadership. Create problem-solving content libraries that address common new business challenges. Develop industry-specific resource guides that demonstrate expertise. Establish SEO-optimized thought leadership content that prospects discover during research.

Phase 2: Solution Analysis and Vendor Identification involves comparing multiple solutions and seeking recommendations. New businesses are open to new vendor relationships without preconceived notions.

Demonstrate unique value propositions clearly and provide social proof through relevant case studies. Develop comparison guides highlighting your advantages over competitors. Create case studies specific to new business challenges that resonate with startup situations. Build testimonial libraries from recent startup clients who faced similar decisions.

Phase 3: Vendor Evaluation and Selection features deep-dive analysis with stakeholder involvement and trial requests. New businesses have fewer stakeholders and faster decision-making processes.

Provide detailed demonstrations and flexible trial options that accommodate new business timelines. Streamline demo and trial processes for efficiency. Create new business-specific pricing options that work with startup budgets. Develop rapid implementation timelines that get new clients operational quickly.

Phase 4: Purchase Decision and Implementation involves final negotiations, contract terms, and implementation planning. New businesses show higher urgency and less complex approval processes.

Offer flexible terms and dedicated onboarding support that recognizes new business needs. Provide new business-friendly contract terms that accommodate growth projections. Create accelerated onboarding programs that reduce time-to-value. Develop dedicated new client success resources that ensure positive early experiences.

Sales process optimization strategies should include hybrid engagement models that balance digital resources with human touchpoints. Provide self-service options while remaining accessible for questions. Use personalization at scale through AI and automation for customized outreach. Segment messaging by business stage and industry for maximum relevance. Focus on value-driven conversations that emphasize business outcomes rather than features. Quantify ROI and impact potential in terms new businesses understand.

Practical Strategies for Targeting New Businesses

Research and identification tactics vary in effectiveness and efficiency. Traditional methods include business registration databases, but these are time-consuming with outdated information. Industry publications and news sources provide limited coverage with delayed reporting. Networking events and referrals offer limited scale with inconsistent quality.

Modern automated approaches use AI-powered monitoring systems for real-time business identification. Real-time notification platforms alert you immediately when relevant businesses register. Geographic and industry filtering capabilities ensure you receive only qualified leads that match your ideal customer profile.

Outreach timing and messaging become important within the first 30 days after business registration.

Week 1-2 requires congratulatory messaging with helpful resources rather than sales pitches. Acknowledge their new venture and express genuine interest in their success. Focus on providing value through relevant industry insights or startup resources.

Week 3-4 should feature educational content addressing common startup challenges. Share case studies from similar businesses or industry best practices. Position yourself as a helpful resource rather than just another vendor.

Beyond 30 days requires traditional sales approaches as the opportunity window closes and competition increases.

Message crafting for new businesses should include congratulations and recognition that acknowledges their new venture. Express genuine interest in their success rather than your sales goals. Reference specific business setup challenges that demonstrate understanding. Offer solutions for immediate needs rather than long-term possibilities. Provide value before making sales pitches to establish credibility. Build relationships through helpful resources and industry expertise.

Channel optimization requires different approaches for different prospect types.

Email outreach best practices include subject lines that focus on timing and relevance. Content structure should be brief, valuable, and action-oriented. Follow-up cadence needs respectful persistence with value-added touches rather than repeated sales messages.

Multi-channel approaches include LinkedIn connection requests with personalized notes. Phone calls work well for high-value prospects who warrant direct attention. Direct mail can be effective for premium service offerings that justify the investment.

Measuring and optimizing results requires tracking specific key performance indicators. Monitor response rates by outreach timing, comparing 0-30 days versus 30+ days performance. Track conversion rates by message type, analyzing congratulatory versus educational versus sales approaches. Calculate ROI by lead source, comparing automated versus manual identification methods.

Continuous improvement processes should include A/B testing message variations to identify optimal approaches. Analyze response patterns by industry to refine targeting criteria. Adjust timing and messaging based on actual performance data rather than assumptions.

Technology and Tools for Modern B2B Sales

Essential technology stack components support efficient new business targeting and engagement.

CRM integration and management systems organize contacts and implement lead scoring based on business age and industry. Activity tracking and pipeline management monitor outreach effectiveness and follow-up timing. Automated follow-up sequences and reminders ensure consistent engagement without manual oversight.

AI-powered lead intelligence provides intent data and behavioral analysis that identifies buying signals. Predictive scoring and prioritization focus efforts on highest-probability prospects. Automated research and contact enrichment saves time while improving personalization.

Communication and engagement platforms enable multi-channel outreach orchestration across email, phone, and social channels. Personalization at scale capabilities customize messaging for individual prospects. Response tracking and optimization tools measure and improve campaign performance continuously.

Selection criteria for sales technology should prioritize integration capabilities that ensure smooth data flow between platforms. API availability and customization options accommodate specific business needs. Existing system compatibility requirements prevent costly platform replacements.

Scalability and growth support includes user and data volume expansion capabilities. Feature advancement and platform evolution keep pace with changing needs. Cost efficiency at different business sizes prevents technology from becoming a growth limitation.

Ease of use and adoption considerations include user interface simplicity and intuitiveness. Training requirements and learning curves affect team productivity. Support and onboarding quality impacts successful implementation and ongoing usage.

Measuring technology ROI involves tracking efficiency metrics like time saved in lead identification and research. Increased outreach volume and consistency improve market coverage. Reduced manual task requirements free up time for high-value activities.

Effectiveness improvements include higher response and conversion rates from better targeting. Better lead quality and qualification increase sales team productivity. Shortened sales cycles and faster deals improve revenue predictability.

Common Mistakes and How to Avoid Them

Timing-related errors represent the most costly mistakes in new business targeting.

Missing the opportunity window occurs when waiting too long to reach out to new businesses. The impact includes increased competition and reduced receptivity as other vendors establish relationships. The solution involves automated monitoring and immediate notification systems that alert you within hours of business registration.

Poor timing execution happens when using generic outreach that ignores business setup stage. Messages appear irrelevant and overly sales-focused, leading to immediate dismissal. Stage-appropriate messaging and value delivery solve this by acknowledging where prospects are in their process.

Message and approach failures create negative first impressions that are difficult to recover from.

Over-aggressive sales tactics involve leading with product pitches instead of value. This creates immediate dismissal and negative brand impression that affects future outreach attempts. An educational, helpful approach that builds genuine relationships prevents this mistake.

Lack of personalization occurs through mass messaging without business-specific relevance. Low response rates and poor engagement result from prospects recognizing generic communications. Research-based personalization and industry-specific messaging demonstrate genuine interest and understanding.

Process and system issues waste resources and miss opportunities.

Inadequate lead qualification means pursuing every new business regardless of fit. This wastes time and resources on poor prospects who will never convert. Clear ideal customer profile criteria and filtering ensure efforts focus on qualified opportunities.

Poor follow-up consistency includes inconsistent or non-existent follow-up processes. Lost opportunities and damaged professional reputation result from failing to maintain contact appropriately. Structured follow-up cadences and automated reminders ensure no prospects fall through cracks.

Technology and data problems undermine even well-intentioned outreach efforts.

Relying on outdated information creates bounced emails and inaccurate outreach attempts. Real-time data sources and automated verification prevent these embarrassing mistakes that damage credibility.

Future Trends and Predictions

Emerging technologies continue shaping B2B sales in ways that will accelerate through 2026 and beyond.

Advanced AI integration includes conversational AI for initial prospect engagement that feels natural while gathering qualification information. Predictive analytics for buying behavior forecasting identify prospects before they recognize their own needs. Automated personalization at unprecedented scale delivers individually relevant experiences to thousands of prospects simultaneously.

Enhanced data intelligence provides real-time business health and growth indicators that reveal optimal outreach timing. Social and digital footprint analysis creates comprehensive prospect profiles. Intent signal sophistication improvements identify buying behavior patterns with increasing accuracy.

Evolving buyer expectations continue pushing toward increased self-service demands. Comprehensive online resource libraries become table stakes rather than differentiators. Interactive product demonstrations and trials replace traditional presentations. Transparent pricing and comparison tools eliminate mystery from purchasing decisions.

Sustainability and ethics focus influences vendor selection as environmental impact considerations become standard evaluation criteria. Corporate social responsibility alignment requirements affect vendor short-lists. Transparency in business practices and values becomes important for establishing trust.

Market dynamics shifts include a competitive intelligence arms race where earlier business identification becomes necessary for success. Speed of outreach determines success rates as first-contact advantage grows more important. Relationship building timeline compression means initial impressions carry more weight than ever.

Global economic influences continue affecting buying patterns. Remote work normalization changes business services needs and delivery expectations. Economic uncertainty drives faster decision-making as businesses avoid prolonged evaluation periods. Budget optimization and ROI focus intensification makes value demonstration required.

Preparing for the next evolution requires strategic investment priorities in technology infrastructure and automation capabilities. Team training and skill development programs ensure human capital keeps pace with technological advancement. Data quality and intelligence enhancement becomes increasingly important as AI relies on clean, accurate information.

Strategic planning considerations should emphasize adaptability and flexibility in sales processes. Continuous learning and optimization cultures prevent stagnation in rapidly changing markets. Customer-centric approach evolution puts buyer needs first in every interaction.

Measuring Success and ROI

Effective measurement systems track the metrics that matter most for new business targeting success.

Response Rate Analysis compares new business outreach (25-40%) versus established business outreach (2-5%). Track performance by timing windows, with 0-30 days post-registration showing optimal results. Monitor message type effectiveness, comparing congratulatory, educational, and direct sales approaches.

Conversion Tracking measures progression from initial response to closed deals. New businesses typically show higher conversion rates due to immediate needs and fewer competing priorities. Calculate time-to-close differences, as new businesses often make decisions within 1-2 weeks versus 2-6 months for established companies.

ROI Calculations demonstrate the financial impact of new business targeting. Customer acquisition costs are typically 40-60% lower for new businesses due to higher response rates and faster decisions. Lifetime value potential often exceeds established business clients due to early relationship establishment and growth trajectory alignment.

Quality Metrics assess lead qualification accuracy and sales team satisfaction. New business leads should score higher on qualification criteria and require less nurturing. Sales team feedback indicates preference for new business prospects due to higher engagement and faster cycles.

Competitive Analysis tracks win rates against competitors. New business targeting typically shows higher win rates as vendors compete on value rather than displacing existing relationships. Market share gains accelerate when consistently reaching new businesses first.

Technology Performance measures platform effectiveness and automation accuracy. Lead identification speed directly correlates with outreach success rates. Data quality scores affect personalization effectiveness and response rates. Integration efficiency impacts sales team productivity and adoption rates.

Continuous improvement processes should include quarterly performance reviews comparing different time periods and approaches. Monthly optimization sessions adjust messaging and targeting criteria based on actual results. Weekly tactical adjustments respond to immediate market feedback and competitor actions.

Building Your New Business Strategy

Creating a comprehensive new business targeting strategy requires systematic planning and execution across multiple dimensions.

Market Analysis begins with identifying your ideal customer profile within the new business segment. Industry preferences, company size parameters, geographic focus areas, and service needs alignment create targeting criteria. Competitive analysis reveals white space opportunities where fewer vendors focus on new businesses.

Resource Allocation determines team capacity and technology investment requirements. Dedicated new business specialists versus integrated team approaches each offer advantages depending on company size and market complexity. Technology budget allocation should prioritize automated identification and contact enrichment capabilities.

Message Development creates stage-appropriate communications for different outreach windows. Congratulatory messages for week 1-2 post-registration focus on acknowledgment and helpful resources. Educational content for weeks 3-4 addresses common startup challenges and industry insights. Sales-focused messages for post-30 days compete with traditional approaches but with relationship foundation advantages.

Process Documentation establishes repeatable systems for consistent execution. Lead identification workflows ensure no opportunities are missed. Outreach sequencing maintains appropriate timing and messaging. Follow-up protocols maintain engagement without becoming pushy or irrelevant.

Training and Development prepares sales teams for new business engagement differences. Messaging training emphasizes value delivery over product features. Timing training teaches optimal outreach windows and approach modifications. Objection handling training addresses common new business concerns about vendor selection and budget allocation.

Performance Management creates accountability systems and improvement processes. Individual performance metrics work with new business targeting goals. Team performance tracking identifies best practices and training needs. Company-wide KPIs demonstrate program effectiveness and ROI achievement.

Success requires commitment to long-term relationship building rather than quick transactional approaches. New businesses become established businesses, making early relationship investment valuable for future growth opportunities.

Advanced Tactics for Competitive Advantage

Sophisticated new business targeting approaches create sustainable competitive advantages that are difficult for competitors to replicate.

Micro-Segmentation divides new businesses into specific categories based on industry verticals, funding sources, founder backgrounds, and technology adoption patterns. Each segment requires tailored messaging and value propositions that address specific challenges and opportunities.

Predictive Modeling uses historical data to identify which new business characteristics predict highest success probability. Company registration information, website sophistication, social media presence, and initial hiring patterns provide qualification signals before direct contact.

Content Syndication creates valuable resources specifically for new business audiences. Industry startup guides, compliance checklists, vendor selection frameworks, and budget planning templates position your company as a trusted advisor before sales conversations begin.

Partnership Development establishes relationships with business registration services, legal firms, accounting practices, and co-working spaces that serve new businesses. Referral programs and joint marketing initiatives create lead flow advantages over competitors who rely only on direct identification methods.

Community Building develops new business owner networks through meetups, online groups, mastermind programs, and industry events. Thought leadership within these communities creates natural referral opportunities and first-contact advantages when members need services.

Marketing Automation Integration connects new business identification with nurture sequences that deliver value over time. Behavioral tracking identifies engagement levels and buying signals for optimal sales handoff timing. Lead scoring incorporates new business-specific criteria for accurate qualification.

Implementation requires patience and consistency as competitive advantages compound over time. First-mover advantages in new business targeting create market position that becomes increasingly difficult for competitors to challenge.

FAQ

Q: How quickly should I reach out to newly registered businesses?

A: Contact new businesses within the first 30 days of registration for optimal results. The first 1-2 weeks show the highest response rates (25-40%) as businesses are actively seeking service providers. After 30 days, response rates drop to levels similar to established businesses (2-5%).

Q: What type of messaging works best for new business outreach?

A: Start with congratulatory messages that acknowledge their new venture and provide helpful resources. Avoid sales pitches in initial contact. Focus on educational content addressing common startup challenges. Position yourself as a helpful industry resource rather than just another vendor.

Q: How do I identify newly registered businesses in my target market?

A: Use AI-powered monitoring platforms like Local Leads that track business registrations in real-time. Set up geographic and industry filters to receive qualified leads automatically. Traditional methods like manual database searches are too slow and often contain outdated information.

Q: What's the typical sales cycle for newly registered businesses?

A: New businesses typically make decisions within 1-2 weeks compared to 2-6 months for established companies. They have fewer stakeholders, less bureaucratic approval processes, and immediate needs that drive faster decision-making. This creates opportunities for shorter sales cycles.

Q: How do I measure ROI from new business targeting?

A: Track response rates (should be 25-40% vs. 2-5% for established businesses), conversion rates, customer acquisition costs, and time-to-close metrics. Companies targeting new businesses typically see 300% higher ROI due to reduced competition and faster decision cycles. Monitor these metrics monthly to optimize your approach.